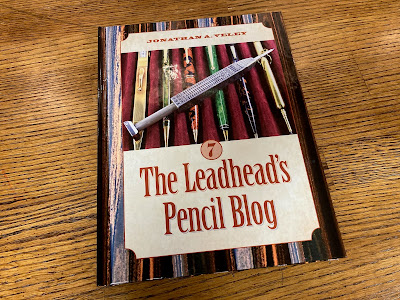

This article has been included in The Leadhead's Pencil Blog Volume 7, now available here.

If you don't want the book but you enjoy the article, please consider supporting the Blog project here.

As detailed in yesterday’s article, Marx Finstone’s personal history is a convoluted one. Maybe the editors of the New York directories just couldn’t get the poor guy’s name right, calling him “Mark Finston” and “Max Finstone” at times. Then again, maybe Finstone was deliberately adopting aliases; before the unincorporated “Eclipse Fountain Pen Company,” who knows what pen brand names Finstone used?

Was Finstone deliberately trying to throw people off his trail? Perhaps . . . after Finstone’s sudden death on December 22, 1927, his secret master plan was revealed: to merge The Eclipse Pen and Pencil Company with its biggest competitor, the New Diamond Point Pen Company – without Diamond Point knowing it.

First, for bit of background about the New Diamond Point Pen Company. The company’s early history spilled out in a lawsuit filed decades later, on August 6, 1943 (Kolber v. Kolber, New York Supreme Court). Briefs filed in the appeal of that case neatly lay out the ownership of New Diamond Point, beginning in 1921 when Charles Flaum, a wealthy businessman with no experience in the pen business, wound up with 100 percent of the shares in New Diamond Point after his son-in-law passed away.

Flaum was “anxious to find associates who would take a more active part in the business.” Morris Kolber left the liquor business to become a shareholder, as did Morris Neulander, a milliner, and each of them bought 25 percent of the company’s stock. Morris Kolber was in charge of manufacturing, and Neulander handled shipping for the company.

Between 1921 and 1925, Flaum sold another 25 percent of the stock to Nathaniel S. Worth; shortly after, Nathaniel’s son, James V. Worth, joined the firm, and he became an equal owner of New Diamond Point’s shares – as of 1925, the five shareholders (each owning 20 percent) were Flaum, Kolber, Neulander, Nathaniel Worth and James Worth. The Worths became dissatisfied with New Diamond Point and started looking for other options . . .

Enter Marx Finstone, owner of all but two share in Eclipse Pen and Pencil Company.

In 1926, Marx was obsessed with finding a way to merge his Eclipse Pen and Pencil Company with three other New York pen companies: New Diamond Point, Salz, and J. Harris & Co. His overtures to New Diamond Point had been flatly refused – the Worths and their 40 percent stock ownership supported the merger, but they were outvoted by the other three shareholders. The unhappy Worths and Finstone therefore hatched a plan for Finstone to secretly accomplish what New Diamond Point had publicly refused.

The plan went sideways, and in retrospect it would have failed anyway; however, Finstone’s untimely death hastened the lawsuit that was filed in New York Supreme Court, Nathaniel S. Worth v. Charles Flaum.

On December 26, 1926, the Worths and Marx Finstone entered into a contract providing that the Worths would come and work for Eclipse. Each of them would trade their 80 shares in New Diamond Point for shares in the Eclipse Pen and Pencil Company of equal value – the number of shares was left blank in the contract until the accountants could finish Eclipse’s annual report, which would provide the value of Eclipse stock.

The parties acknowledged in their agreement that the Diamond Point shares were subject to a shareholder agreement dated February 14, 1924, which required the Worths to give New Diamond Point 60 days’ notice before selling their shares. New Diamond Point would have the right to repurchase them first.

In January, 1927, Eclipse’s accountants concluded that the 80 shares each of the Worths owned was worth the equivalent of 62 shares of Eclipse common stock and 536 shares of preferred stock. On June 30, 1927, James handed over his New Diamond Point shares to Finstone, and Finstone issued shares of stock to James Worth as provided in the agreement.

Nathaniel, though, had a problem. He didn’t tell Finstone that he had bought his shares in New Diamond Point from Charles Flaum on a installment payment plan, and Flaum was still holding Nathaniel’s shares as collateral until they were paid off. There was still $2,700.00 due.

Nathaniel claimed – after the litigation started – that at the time the contract was signed, he didn’t say anything to Marx Finstone about his deal with Flaum because he thought he would be able to just walk into Flaum’s office, hand him $2,700.00, get his shares and bring them back to Finstone to trade them for his Eclipse shares.

Nathaniel was a moron.

The record is unclear whether either of the Worths ever gave notice to New Diamond Point that they were selling their shares, but either way the “secret” infiltration of Marx Finstone into the company could not possibly have been a secret. The remaining shareholders in New Diamond Point had just voted that they did not want to be in business with Marx Finstone.

If shortly after that vote the dissenting shareholders gave notice that they were selling their interests, New Diamond Point would know Finstone was trying to sneak in the back door and, with Charles Flaum’s vast resources behind it, New Diamond Point would certainly repurchase the Worths’ shares.

Therefore, it is not surprising that when Nathaniel Worth walked into Charles Flaum’s office with $2,700.00 to pay off the balance due on his New Diamond Point shares, Flaum refused to accept it and refused to turn over Nathaniel’s share certificate. Finstone refused to give Nathaniel any shares in Eclipse until he could produce the share certificate, so Nathaniel gave Finstone $3,000.00 – apparently, the $2,700.00 plus something for interest accrued on the debt – and Nathaniel testified that Finstone was going to go and personally demand the shares from Charles Flaum.

By late 1927, Nathaniel had given Marx Finstone $3,000.00, he didn’t have his New Diamond Point shares, and Finstone had not yet issued him his Eclipse shares. Right at that critical moment, on December 22, 1927, Marx Finstone suddenly died. David Klein testified that he was present when Nathaniel confronted Finstone’s widow, Lillian Finstone, and demanded his shares in Eclipse. In response, Lillian simply fired him.

Without Marx Finstone’s leadership, Eclipse quickly ran into financial trouble and was placed in receivership, while the executors of Finstone’s estate scrambled to pick up the pieces. By the time Nathaniel Worth filed his lawsuit, all parties were in agreement that shares of stock in Eclipse were essentially worthless.

The lawsuit Nathaniel filed was against Charles Flaum, demanding the return of his shares in New Diamond Point. Nathaniel claimed he had the right to sue for them pursuant to a part of his agreement with Marx Finstone, which required him to do so in order to keep his dealings with Marx a secret. On the other hand, lawyers for Finstone’s estate argued that since Nathaniel had already sold all of his interest in New Diamond Point in exchange for the now worthless shares in Eclipse, if anyone had the right to sue Charles Flaum, it was Finstone’s estate.

This entire history survives only because the Court denied Nathaniel’s request to switch lawyers, and Nathaniel appealed that minor procedural ruling. There’s no written opinion I could find which explains what ultimately happened in Nathaniel’s case – at least, not directly.

The 1943 litigation between the Kolbers over the ownership of New Diamond Point contains an offhand remark by one of the attorneys which clarified the ultimate outcome: “Around 1926, as a result of litigation the two Worths sold their shares [in New Diamond Point] to the remaining members of [New Diamond Point] for a total price of $21,221.50, financed in equal shares by the purchasers.”

All that effort the Worths and Marx Finstone put into their scheme was for naught; predictably, New Diamond Point repurchased the shares of the company rather than allow them to fall into the hands of Finstone’s heirs. For the Worths, it was somewhat of a happy ending – at least they were compensated for their investment in cash, rather than being forced to exchange it for worthless stock in Eclipse.

Eclipse, for its part, survived its receivership; apparently, once Finstone’s executors sorted out this mess (and likely, many others Finstone left behind), the company was able to recover. M. David Klein (who was Finstone’s brother in law, as he stated in an affidavit filed in the 1929 appeal) took over leadership of the company, which thrived at least as well as any pen company could during the Depression.

No comments:

Post a Comment